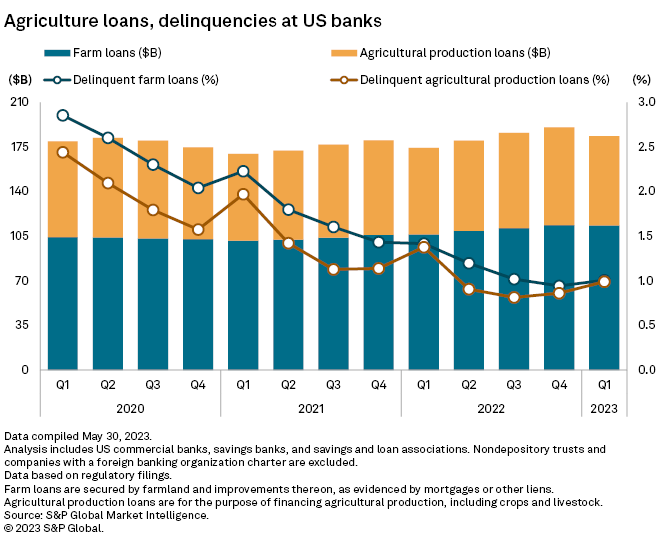

As weaker crop prices, rising interest rates and the recent banking turmoil dampened US farmer sentiment, agriculture loans at US banks and thrifts declined in the first quarter, halting an uptrend in the previous five quarters. Meanwhile, the sector's delinquency rate ticked up from the preceding quarter.

Still better than last year

Total US agriculture loans slipped 3.62% to $183.59 billion in the first quarter from $190.48 billion in the fourth quarter of 2022, while the overall sector delinquency rate inched up to 1.00% from 0.91%, according to S&P Global Market Intelligence data analysis.

However, the sector remained in better condition than a year ago as total agriculture loans grew 5.29% from $174.37 billion in the first quarter of 2022. The sector's overall delinquency rate was also over 40 basis points lower than a year ago.

Delinquencies inch up

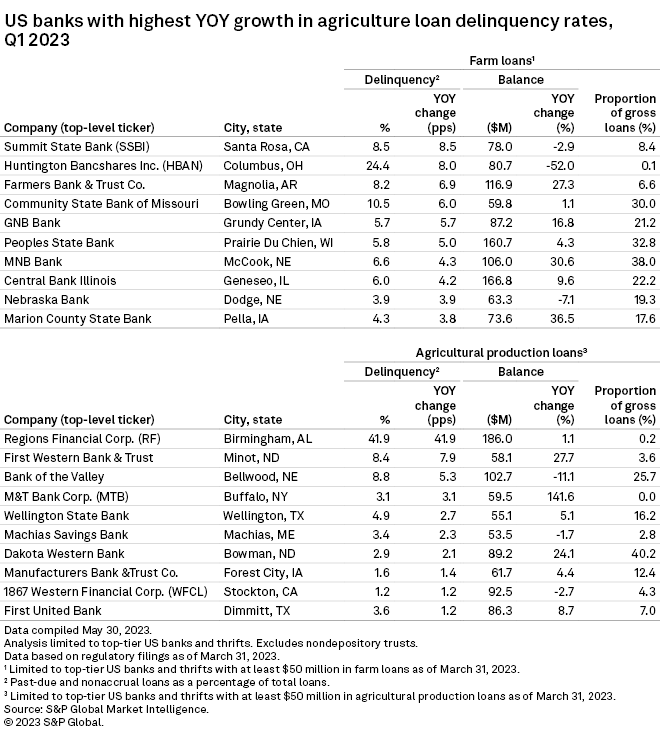

Santa Rosa, Calif.-based Summit State Bank recorded the highest year-over-year increase in farm loan delinquency rate in the first quarter, up 8.5 percentage points, followed by Columbus, Ohio-based Huntington Bancshares Inc. with an 8-percentage-point rise.

Huntington also posted the highest delinquency rate at 24.4% in farm loans in the first quarter, although its farm loans — those secured for farms and improvements — decreased by 52.0% from a year ago.

In agricultural production loans — those for funding agricultural production, including crops and livestock — Birmingham, Ala.-based Regions Financial Corp. posted the highest delinquency rate at 41.9% as well as the highest year-over-year delinquency rate growth of 41.9 percentage points in the first quarter. Minot, ND-based First Western Bank & Trust, up 7.9 percentage points, was a distant second in year-over-year delinquency rate increase.

Top agricultural lenders

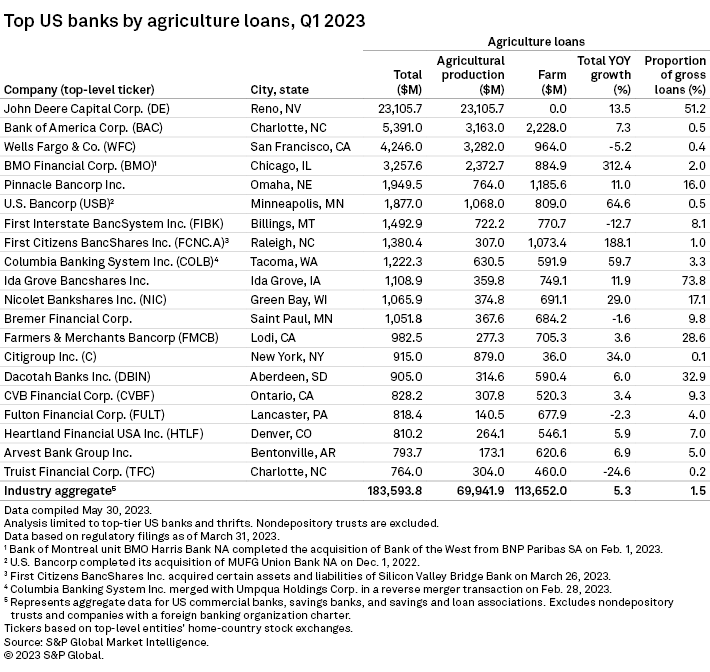

John Deere Capital Corp. remained the largest lender to the US agriculture sector, with its agriculture loans increasing 13.5% year over year to $23.11 billion, accounting for more than half of its gross loan portfolio in the first quarter. The Reno, Nev.-based bank made only agricultural production loans and zero farm loans in the first quarter.

Bank of America Corp., the second-largest US agricultural lender by a margin, totaled $5.39 billion in loans to the sector, representing 0.50% of its gross loan portfolio, in the first quarter.

Chicago-based BMO Financial Corp. posted the industry's biggest year-over-year increase in agriculture loans during the period — more than 4x of what it had a year ago. BMO acquired San Francisco-based Bank of the West from French lender BNP Paribas SA through subsidiary BMO Harris Bank NA on Feb. 1. Before the merger, Bank of the West had total agriculture loans of $2.99 billion, while BMO Harris had only $678.1 million in combined agricultural production and farm loans, as of the fourth quarter of 2022. Agriculture loans now account for about 2.1% of BMO's gross loans.

Growing concern

Farmers' prospects in 2023 were clouded by the interest rates and the bank failures that dominated March. Rising interest rates have grown to be the sector's top concern for the year ahead, eclipsing input costs, according to the March report of farmer sentiment monitor Purdue University/CME Group.

The recent banking turmoil and its potential to hurt the economy also likely weighed on producers' sentiment, according to the report.